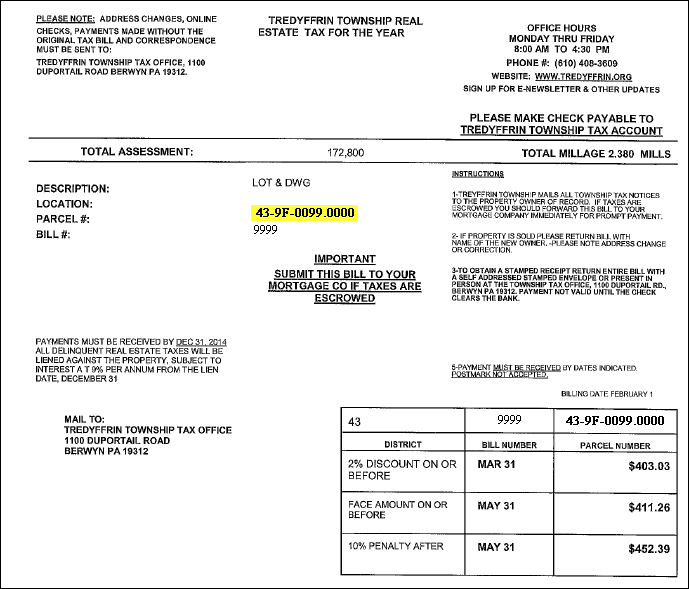

Please enter your Parcel # as it appears on your Tax Bill (ex: 43-9F-0099.0000 ). For assistance locating this number on your bill, refer to the sample image below.

- 2% discount on or before March 31st

- Face amount on or before May 31st

- 10% penalty after May 31st

- All payments must be received by December 31st

- Please allow up to 3 business days for payments to be reflected online

Service Suspended by Town

Please contact Town for more information.